The Only Guide for Financial Advisor

Wiki Article

The Best Guide To Roth Iras

Table of ContentsLittle Known Facts About Financial Advisor.Planner - The Facts6 Easy Facts About Sep Explained

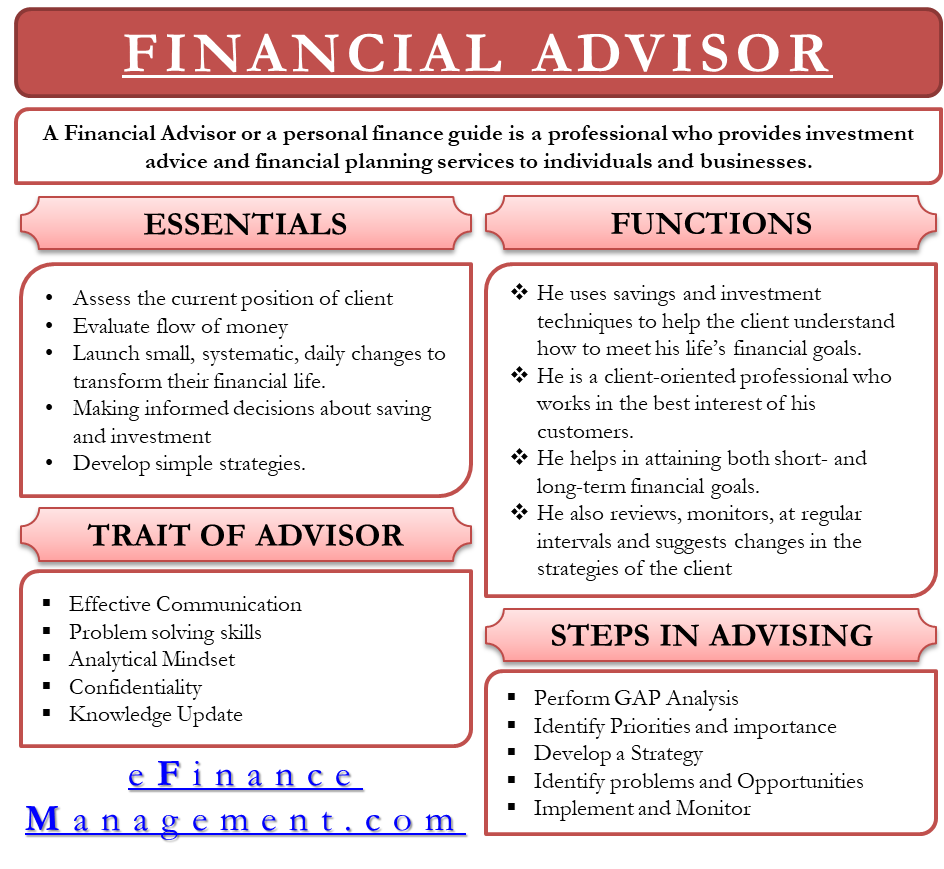

A monetary advisor serves as a trusted advisor as well as overview, utilizing their knowledge and also understanding of financial markets to develop customized financial plans and also approaches that meet each customer's one-of-a-kind requirements as well as objectives. They work to aid their clients achieve a stable monetary future as well as security and also assist them navigate complicated monetary decisions as well as difficulties.

The smart Trick of 529 Plans That Nobody is Discussing

A financial consultant can help you address and also take care of any type of arrearages as well as create a technique to end up being debt-free. A monetary consultant can aid you intend to disperse your properties after your death, including creating a will as well as setting up counts on. A monetary expert can help you comprehend as well as take care of the threats connected with your financial scenario and financial investments - 529 Plans.

A monetary advisor can assist customers in making investment choices in numerous means: Financial advisors will certainly collaborate with customers to comprehend their threat tolerance as well as create a customized financial investment strategy that straightens with their objectives as well as comfort degree. Advisors usually suggest a varied portfolio of financial investments, including supplies, bonds, and also various other properties, to assist alleviate danger as well as maximize possible returns.

Financial experts have substantial understanding and experience in the economic markets, and also they can assist clients comprehend the potential advantages as well as threats linked with different investment alternatives. Financial advisors will on a regular basis evaluate customers' portfolios and make recommendations for adjustments to guarantee they stay aligned with customers' objectives and have a peek at these guys also the existing market conditions (401(k) Rollovers).

Some Known Details About Advisor

Yes, a financial expert can aid with debt administration. Financial obligation administration is necessary to total economic planning, and financial experts can give guidance as well as assistance in this field. A financial advisor can aid customers understand their debt scenario, More hints evaluate their current financial debts, as well as develop a financial obligation monitoring strategy. This might consist of establishing methods for paying off high-interest debt, combining financial debt, and developing a spending plan to take care of future spending.

Financial consultants usually obtain paid in one of several a number ofMeans Some financial try these out economic experts make commission compensation selling marketing economic, such as mutual shared, insurance products, or annuities. It's crucial to find an expert that pays attention to your demands, understands your monetary circumstance, and also has a tried and tested track record of assisting customers attain their monetary goals. In addition, a monetary expert can aid produce a detailed monetary strategy, make suggestions for investments as well as risk management, as well as offer ongoing assistance as well as keeping track of to assist make certain clients reach their monetary goals.

Report this wiki page